Africa’s financial landscape is evolving rapidly, driven by a growing population, expanding digital adoption, and an urgent need for financial inclusion. Financial institutions across the continent are facing increasing pressure to innovate, adapt, and meet the changing needs of their customers. AI-powered solutions offer a unique opportunity to transform financial services, enabling institutions to drive growth, manage risk, and unlock new opportunities.

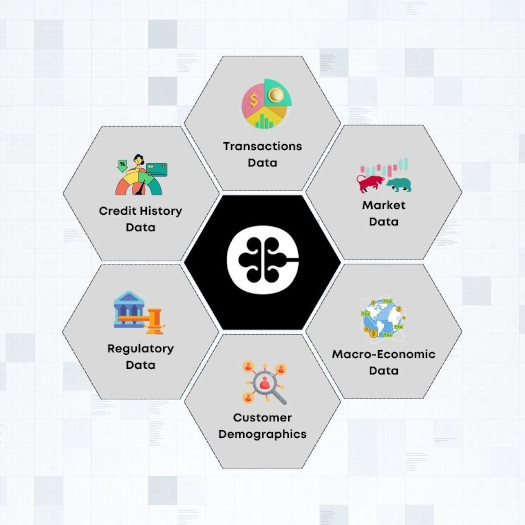

CipherSense’s AI-powered solutions are designed to help financial institutions across Africa harness the power of AI to enhance decision-making, optimize risk management, and expand access to underserved populations. Our advanced AI algorithms can help you detect and prevent fraud, improve credit scoring, and deliver personalized financial products and services to your customers. By leveraging AI, financial institutions can unlock new insights, streamline operations, and drive innovation in the rapidly evolving financial services landscape.

Key Challenges with Financial Services in Africa

-

Millions of Africans lack access to formal financial services, limiting economic opportunities. This lack of access is driven by factors like limited infrastructure, financial literacy, and stringent eligibility requirements.

-

Financial institutions are increasingly vulnerable to fraud and financial crime, with criminals using sophisticated techniques to exploit weaknesses in existing systems. Traditional fraud detection methods are no longer sufficient to protect against evolving threats.

-

Financial institutions face increasing regulatory requirements and compliance challenges, making it difficult to manage risk effectively. Manual processes and siloed data further complicate risk management efforts, leading to inefficiencies and increased exposure to fraud and financial crime.

-

Data fragmentation across systems and departments hinders financial institutions’ ability to gain a holistic view of their operations. Siloed data leads to inefficiencies, inaccuracies, and missed opportunities for insights and analysis.

How CipherSense is Transforming Finance

-

CipherSense AI offers alternative credit scoring engine that leverage non-traditional data sources to assess creditworthiness. By analyzing factors like mobile phone usage, transaction history, and utility bills we can provide more accurate risk assessments and expand access to credit for underserved populations.

Benefits:

-

Enable financial institutions to extend credit to underserved populations.

-

Improve risk prediction using AI-driven insights.

-

Reduce loan default rates by better assessing borrower risk.

-

CipherSense AI’s predictive analytics models help financial institutions make data-driven decisions by analyzing historical data, identifying patterns, and forecasting future trends. By leveraging AI insights, institutions can optimize investment portfolios, enhance customer segmentation, and forecast market trends more accurately.

Benefits:

-

Optimize investment portfolios for better returns.

-

Enhance customer segmentation and targeting.

-

Forecast market trends and indentify emerging opportunities.

-

CipherSense AI’s fraud detection model and API can help financial institutions identify and prevent fraudulent activities by analyzing transaction data, customer behavior, and historical patterns. By leveraging AI insights, institutions can detect anomalies, flag suspicious activities, and take proactive measures to mitigate risk.

Benefits:

-

Real-time detection of fraudulent activities.

-

Minimize losses due to fraud and financial crime.

-

Improve customer trust and loyalty.

-

CipherSense AI’s customer experience personalization tools help financial institutions deliver tailored products and services to their customers. By analyzing customer data, preferences, and behavior, institutions can create personalized offers, recommendations, and communication strategies that drive customer loyalty and revenue growth.

Benefits:

-

Increase customer loyalty through personalized financial products and services.

-

Drive revenue growth by offering tailored solutions to meet customer needs.

-

Improve customer experience with targeted marketing and communication.